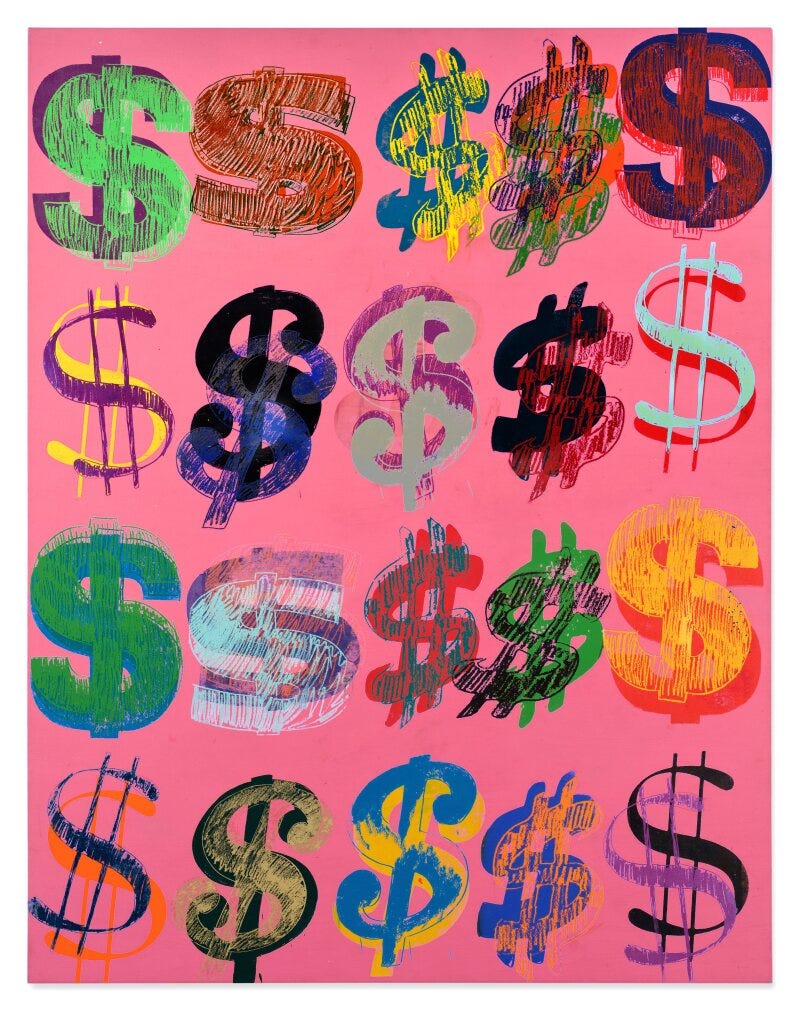

Art Pricing in the Primary Market

The primary market represents the first sale of an artwork – directly from the artist's studio or gallery. It operates on different principles than the secondary art market (resale of artwork, typically through auction). Pricing is essential for artists and gallerists looking to sell a piece and art buyers who expect logical valuation and potential appreciation calculations.

Different art forms have different rules. In this article, I focus on works by young and mid-career painters. This formula provides a consistent pricing foundation that considers both the artwork's size and professional growth in the long term (not suitable for artists who create decorative artworks):

(Height cm + Width cm) × Index number = Price

The index number is a personal subjective multiplier reflecting the artist's professional achievements and market position. It should be reviewed annually, based on:

Exhibition history:

Solo shows in recognized galleries

Group exhibitions in prestigious institutions

Museum exhibitions

Biennales and important art fairs

Awards and recognition:

Important art prizes

Significant grants

Residencies at well-known institutions

Critical reviews/publications

Collections:

Museum acquisitions

Inclusion in important private or corporate collections

Setting the Initial Index

Recent art academy graduates: 3–10

Artists with 2–5 years of exhibition history: 11–15

Mid-career artists with significant exhibitions: 16–50

Established artists with museum exhibitions: 51+

Annual Index Review Procedure

Document all professional achievements from the past year

Evaluate the significance of each achievement

Compare your current market position with previous years

Adjust the index number accordingly:

Minor achievements: 5–10% increase

Essential achievements: 15–25% increase

Breakthrough year: 30–50% increase

This logic allows art sellers (artists, gallerists, agents) to justify artwork prices and art buyers to forecast the expected appreciation of an artist's works or potential investment value.

Several indices exist in the global art market (Mei Moses, Artnet, and others), but they apply to secondary art market works (mostly auctions) – an entirely different topic. To determine prices for deceased artists who have never appeared at auction, comparisons are made with works by similar-level artists who have participated in auctions. However, this area has many nuances and manipulations, so I recommend beginning art collectors consult with an expert. At the same time, young or mid-career artists (primary market), as mentioned, are subject to different pricing rules.